2023 has been a year of uncertainty with the supposed recession and associated doom not seeming to have materialised and unlikely to have the impact some predicted.

Below are five key issues many Australian businesses are facing:

1.Interest Rates

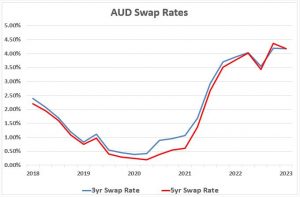

Interest rates have been a topic of conversation over the last year with various predictions about when they will peak. We saw artificially low rates during Covid which have quickly returned to more normal levels over the last year.

This chart provides some perspective. Rates are now around 2% higher than what they were pre Covid 3-4 years ago. Rates look to have stabilised with the 5-year rates similar to the 1- and 3-year rates, which says that the market believes rates are close to the peak and can be expected to fall rather than increase over the next year. It will not be a surprise for the RBA to increase rates one more time however it would appear that the current rates are close to the peak.

2. Foreign Exchange

The AUD continues to trend at lower than historical norms and while this is good news for exporters, the downside is the higher cost of imported goods which in turn puts further pressure on inflation at a national level. There doesn’t seem to be much expectation of exchange rates improving in the short term.

3. Access to finance

The attached article from the RBA is an interesting read. One of the key findings is that Australian SME’s are finding it harder to access finance from their traditional banks, something which we have been seeing for some time. If you are looking for an improved banking relationship with less onerous requirements, less security, better rates, and greater access to finance – please call us, we are here to help you.

4. Labour Supply

The steady growth in immigration is welcome and essential and is slowly starting to fill the massive gap in supply of quality labour. However, skilled labour continues to be expensive and transient which means most businesses need to continue to look for other ways to reduce labour costs and increase productivity. Automation is a continued focus for many businesses, along with trying to introduce AI into the mix.

5. Insurance Premiums

Insurance premiums have jumped in recent years with increases between 20-50% being seen by some customers. This has been exacerbated by a number of underwriters ceasing to offer insurance for customers and industries which are perceived as higher risk. Most businesses have now included Cyber Cover to the overall Insurance.

Don’t forget to ask us about Insurance Premium funding options.

Below are some current initiatives aimed at supporting businesses.

1. Government Grants

Government Grants are being continually re-jigged at both State and Federal levels and continue to be an area which businesses should be continuously working on.

In particular, our customers have benefitted recently from Schemes such as: the Federal – Recycling Modernisation Fund (RMF), Plastics Technology Stream, WA Investment Attraction Fund, Qld Investment Schemes including MIQ.

There is an extensive range of grants which can be complex and confusing. We can introduce you to the industry leading experts if you want to explore further.

2. Electric Cars FBT exemption

Don’t forget the Federal Government FBT exemptions now apply if you are purchasing an electric car. For many employees this becomes an attractive Salary Sacrifice opportunity.

We are here to support your business.

Please speak to us about all things finance. Working Capital Finance including Trade Finance, Property Finance including Construction Finance, Insurance Premium Funding and Equipment Finance as well as Motor Vehicle Finance. And yes, we also do Home Loan Finance.

We know that banks are treating business customers worse than ever – please make us your first point of contact every time – we will get you a better outcome with a far better experience.

Please feel free to call me to chat about any of the above on 0407 746 474 or get in touch via email at andrew.sutherland@halidonhill.com.au